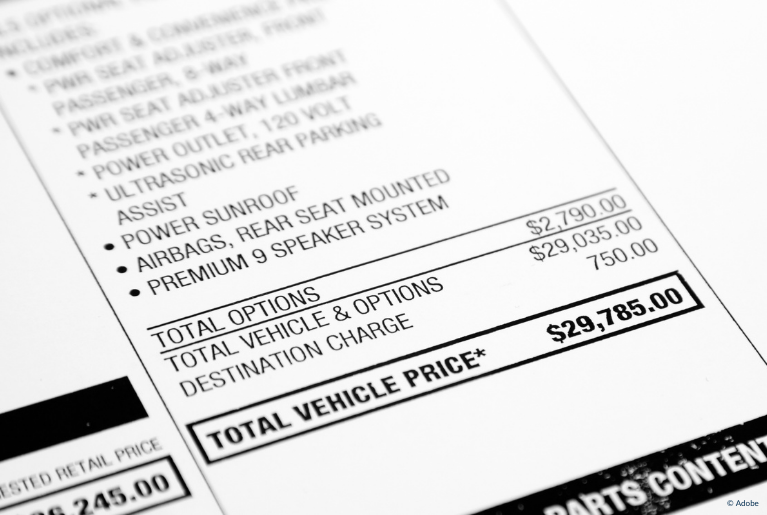

The cost of owning a car is not just the purchase price, fees and sales tax. When you choose a car model, factor in the cost of insuring it. Some models are far more expensive to insure than others, and you do not want to wait until you have already bought the car to find out how much insurance will cost.

Your insurance can be affected by your driving experience, safety record, cost of repairs, how you use your car and where you’re driving your car. Not only that, dealers often require you to have proof of insurance when you purchase your car. If you have insurance, do not let it lapse! If you don’t, make sure to compare quotes and get a plan suited for you.

You might be surprised to know that some insurers will charge you twice as much as competing insurers for identical coverage. The California Department of Insurance conducts a premium survey every year, and you can use their rarely-publicized but very-effective comparison tool to begin rate shopping so as to not overpay.

The following is the minimum coverage legally required of your insurance plan:

- Liability Insurance, which covers damages when you’re found at fault in a car accident. This includes bodily injury liability, which covers injuries caused to someone else, and property damage liability, which covers damage to someone’s property.

- $15,000 for the injury or death of one person

- $30,000 for the injury or death to two or more people

- $5,000 for damage or destruction of property

Consider what you can pay for a premium, which is the recurring fee for your insurance, and what you can pay for a deductible, which is the amount you have to contribute to every claim you file. The lower your premium, the higher your deductible, and vice versa.

Look for any discounts that you may be qualified to get, review auto insurance companies carefully, and check for the agent’s license to sell car insurance. You can do the latter by calling the California Department of Insurance at 1-800-927-4357 or visiting the California Department of Insurance to search the broker or agent by license number or by name.

For those who are struggling financially, California also has a Low Cost Auto Insurance program, which offers basic liability coverage for less than $20 per month in most counties. It is not designed for those seeking cheaper insurance, because its liability limits are very low and could leave you financially on the hook for accidents of even minor seriousness. Rather, it is for drivers of limited means (income under $32,200 for a single person) so they can operate their vehicles legally.

If you have chosen a used or Certified Pre-Owned model car for sale, you will want to get a vehicle report. Read our next post in our Auto Buying Guide to learn how to search up its history and catch any red flags.

Lemon Law Help by Knight Law Group is an automotive lemon law firm that exclusively practices in California, with offices in Los Angeles, San Francisco, Sacramento and Orange County. If you are a California resident who purchased or leased a defective vehicle from a licensed dealership in California, we may be able to help you get rid of your potential lemon and recover significant cash compensation. Model year restrictions apply: 2020–Present vehicle models only.

However, we cannot help those who reside outside of California or purchased their vehicle outside of California unless they are active duty members of the Armed Forces, nor will we be able to refer them to a lemon law firm in their states.

To learn more about the California Lemon Law and your legal rights, visit our guide on the California Lemon Law for more information.