In our last post, we discussed car purchase pitfalls such as vehicles labeled “as-is,” gap insurance, extended warranty plans and yo-yo financing. To avoid that last trap, you have to read the paperwork carefully before taking your car home. However, that’s not the only reason you should read through the stack of papers given to you by your salesperson.

When reading these documents, check through all of the details with a fine-toothed comb. If there are parts of any paperwork that strike you as incorrect, resolve those items before you sign anything. If part of the contract makes you uncomfortable, cross that part out. It’s never too late to back out, at least until you sign the contract.

If you’re buying the car, you will be expected to sign a document called the Retail Installment Sales Contract (RISC). You will receive this regardless whether you pay the full price upfront or have a plan to pay for the vehicle in installments. This document should show the following:

- Name and address of purchaser

- Name and address of dealership

- Year, make, model, mileage and VIN of vehicle

- Purchase date

- Vehicle purchase price

- Down payment or deposit, if any was made

- Vehicle trade-in credit, if any

- Amounts for legally required fees, such as sales tax, registration, and title fees

- Processing fees, if any

- Net balance due, if any

If you’re leasing the car, you will be expected to sign the lease agreement. Though the lease agreement should show many of the same things as the RISC, the lease agreement should also show the following:

- Length or term of the lease

- Mileage limits on the lease

- Excessive wear and tear provisions

- Monthly payments for the car

- Penalties for limits on mileage or wear and tear

- Acquisition fee or bank fee

- Vehicle selling price

- Total amount due at signing

- Buyout price

- Turn-in fee

- Early termination fee

- Money factor, and by extension, interest rates

- Residual value of vehicle

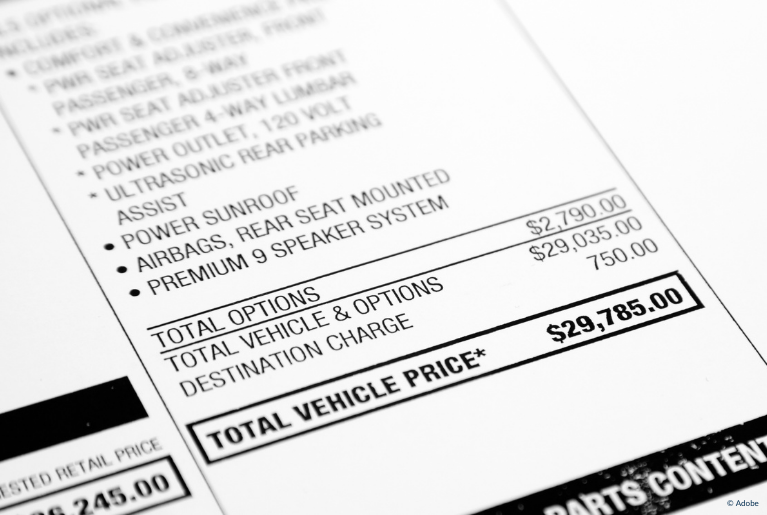

Double-check the math. Carefully review all numbers listed in the paperwork, including but not limited to monthly payments, fees and other expenses. Compare the numbers listed in the offer sheet and the invoice. You should also try to keep all transactions separate to avoid confusion. This means keeping the price of the car separate from down payments, financing costs, trade-ins (if you plan to trade in your current car) and other expenses. Using a calculator is highly encouraged! If any of the listed numbers confuse you, start asking questions.

Some automotive purchase agreements may have an arbitration clause. This means if you later suspect your vehicle to be defective (or a “lemon”), you will be required to go to arbitration with the automaker before you can pursue a lemon law case in court. To learn more, read our California Lemon Law Guide.

Lemon Law Help by Knight Law Group is an automotive lemon law firm that exclusively practices in California, with offices in Los Angeles, San Francisco, Sacramento and Orange County. If you are a California resident who purchased or leased a defective vehicle from a licensed dealership in California, we may be able to help you get rid of your potential lemon and recover significant cash compensation. Model year restrictions apply: 2020–Present vehicle models only.

However, we cannot help those who reside outside of California or purchased their vehicle outside of California unless they are active duty members of the Armed Forces, nor will we be able to refer them to a lemon law firm in their states.

To learn more about the California Lemon Law and your legal rights, visit our guide on the California Lemon Law for more information.